Instructions: Complete the top 5 entry fields and click the “Compute” button. But, as you’re about to discover, you will certainly notice the “increased” cash flow that will occur when you pay your mortgage off way ahead of schedule! This breaks down to a payment of 500 towards interest and 99.55 towards the principal. We also offer a separate biweekly mortgage calculator.

You can use this for any type of loan including home loans.

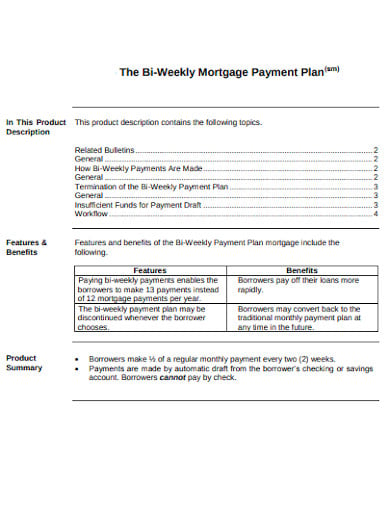

It also makes some assumptions about mortgage insurance and other costs, which can be significant. For a 100,000 loan at 6 percent interest for 30 years, the monthly payment is 599.55. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis. In effect, you will be making one extra mortgage payment per year - without hardly noticing the additional cash outflow. This amortization extra payment calculator estimates how much you could potentially save on interest and how quickly you may be able to pay off your mortgage loan based on the information you provide.

#PAYING EXTRA BIWEEKLY MORTGAGE CALCULATOR FULL#

This calculator will show you how much you will save if you make 1/2 of your mortgage payment every two weeks instead of making a full mortgage payment once a month.

0 kommentar(er)

0 kommentar(er)